Japan’s Millennial Consumer Revolution: Eco-Friendly Frugality and Second-Hand Luxuries

The end of the bubble era brought a stagnant economy upon Japanese millennials leading them to adopt new ways to save money while still not completely sacrificing some of the finer things in life.

Spending habits drastically changed and 'frugality' has become a common definition of this generation. However, in recent years millennials have shown that this attitude has a much deeper meaning related to eco-friendly living when it comes to non-essential goods. Even if it means pushing aside stickling attitudes towards hygiene and perfection in pursuit of buying second-hand cosmetics.

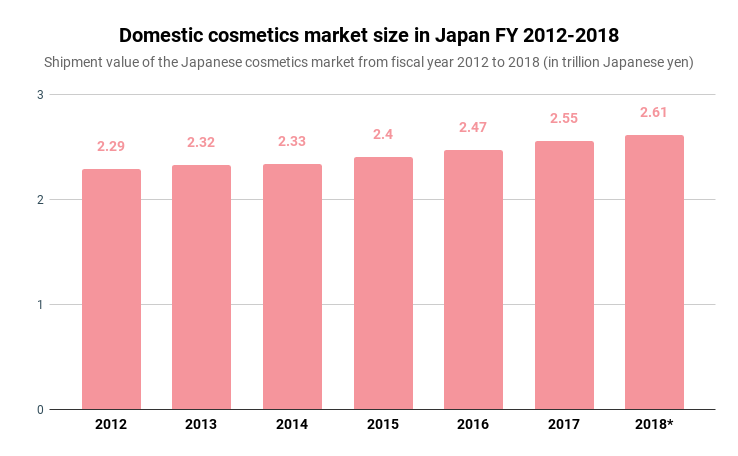

Japan's cosmetics market is a world leader with constant growth at around 10% in shipment value per year since 2014. Consumers are spoilt with endless beauty choices, from low-priced drugstore products to luxury cosmetics.

*Yano Research, Statista 2019

Despite the abundance of possibilities and the improving economy, the second-hand retail market is thriving and making significant inroads into the cosmetics market. Buying used makeup products online has become popular among a growing segment of Japan's millennials, and the phenomenon serves as clear evidence of frugality as well as a “thoughtful consumption culture” of this generation.

These consumers discover new products on social media, and if they are not available in Japan, the products can easily be bought and “used” on e-commerce platforms.

Moreover, luxury brand products can also be found at highly discounted prices. The main factor causing such low prices is that the seller actively uses these products rather than just swatching them, occasionally even using up half of the initial supply.

Smartphone apps, like Mercari, allow used makeup to be sold with the stipulation that the owners follow guidelines, such as items not being expired or damaged. Mercari has become an ideal platform to access luxury cosmetics, which are rarely discounted, satisfying shoppers' desire for branded goods.

Incidentally, after a peak in sales in 2018, Japan's prestige cosmetics market revenue growth is expected to decline in 2020, and considering that these brands mainly target older consumers, it should drastically change how brands market their products to appeal more to a younger demographic.

*Statista, September 2019

"Mercari has become the ideal platform to access luxury cosmetics satisfying the younger shoppers' desire for branded goods"

What’s behind the millennials’ psyche?

Japanese millennials, known as the Yutori ("free from pressure") generation, appear reluctant to spend money on non-essentials. This tendency is often said to be due mainly to events that characterized their up-brining, such as the 2008 global financial crisis and the great earthquake, tsunami, and nuclear disaster of 2011.

The Yutori are accustomed to a stagnant economy, and despite many policies launched by the Abe Administration to boost the economy, frugality seems deeply entrenched in their lifestyles.

According to a 2017 GCT Survey, 57% of young adults intended to decrease their overall spending, and a similar percentage intended to save more money. The latter could be attributed to a lack of stable jobs in addition to (particularly the younger millennials') lack of interest in one "job for life" compared to the previous generation.

Today, a large percentage of young adults work in temporary roles, sometimes unrelated to their qualifications. 61% of single men and 67% of single women aged 25–29 years old continue living with their parents often relying on them for financial support.

*Euromonitor, January 2019

A saving-oriented attitude means millennials' spending habits tend to revolve around cost performance (or "cospa"): specifically, products or services with high durability or performance with the lowest price tag.

Apparently, even young entrepreneurs, known affectionately as the 'Ikina-Rich', are less interested in luxury products and more in qualitative experiences such as traveling and purchasing homes.

This attitude is not limited to the Ikina-rich but is shared among millennial consumers who are focused on the quality and story behind a brand and its products.

"Millennials spending revolves around cost performance"

Sustainability: the new Japanese consumer value

Behind second-hand products with a great quality/price ratio is a story that makes young Japanese consumers overlook hygiene concerns and gives them validation—a qualitative experience resulting from a non-wasteful attitude towards consumerism.

Eco-attitudes towards non-essential goods are increasing, and while many Japanese may not practically be pursuing an ethical lifestyle, consumers aged between 20 and 29 are apparently trying to make a positive impact on the environment every day.

*Euromonitor, January 2019

In fact, used makeup, like second-hand clothing, is more environmentally friendly. From this perspective, Japanese millennials are less characterized by frugality than by environmental consciousness and clever saving skills. Thrifting has become a virtue and a creative outlet for this more sensitive generation.

Second-hand purchases might not be exclusively related to low household income, as salary increases alone may not stimulate consumption. The latter highlights a much broader issue of how brands target and market themselves to younger Japanese consumers.

Jefferies Group LLC analyst Mitsuko Miyasako mentioned in an interview how "people's preferences are fragmenting" and that it is essential for a company to identify the right target segment and the image it wants to project. Japanese companies like Shiseido are creating new, less expensive cosmetic lines to appeal to the price-conscious Japanese millennials.

Cosmetics and luxury brands should take into consideration the growing eco-attitudes of these consumers as well as their price sensitivity. Frugality might not be the only reason behind the millennial consumer psyche. They need a story to be behind the brand and the product to give them more “purpose” to spend and more opportunities to engage in fulfilling experiences.

Based in Tokyo, An-yal is the leading independent advertising agency for global lifestyle brands in Japan and worldwide. Contact us to get ahead with your integrated marketing and creative needs.